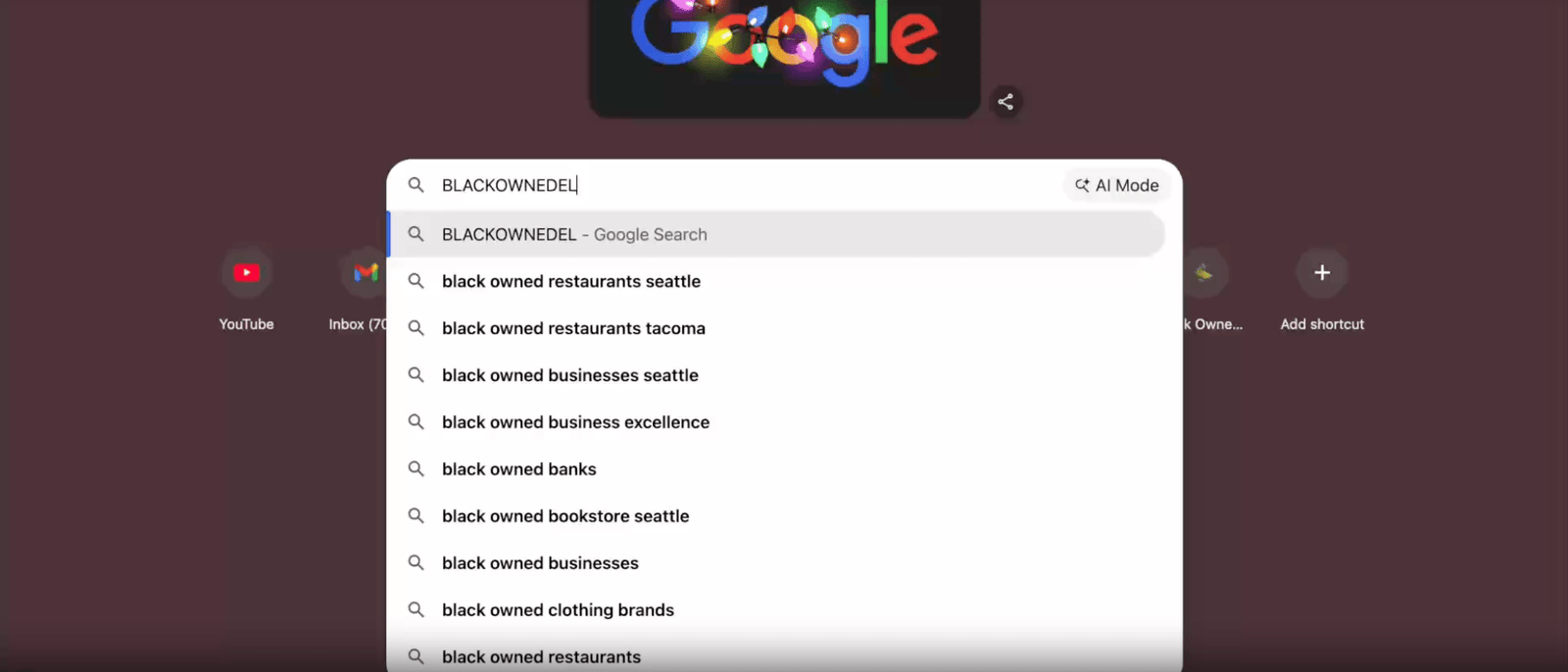

Explore Nearby Black Owned Businesses

Explore high-quality, pre-vetted businesses in our community.

Or browse featured categories:

Amazing Fan Made Video Thanks so much to Kenneth Cash!

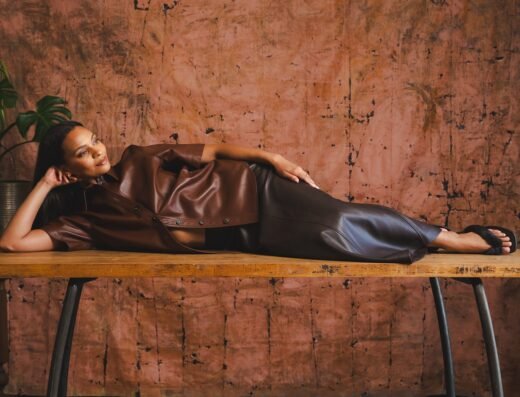

Featured Black Owned Brands

Featured Black Owned Brands

Newly Picked Businesses

Explore by Category

Great Black Brands To Support

How It Works?

Join Our Community

Earn extra income and unlock new opportunities by advertising your business